Mubasher: Apple (AAPL) shares pulled back after hitting an all-time high near $288.60 in December 2025, as investors took profits. The stock later found support around $243.75, where buying interest resurfaced along an upward trend line that has guided prices higher since April 2025.

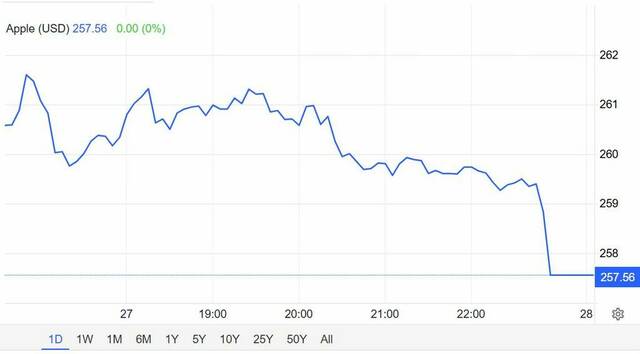

The price then began to rise, supported by high trading volumes, closing yesterday's session at $258.27.

The stock opened pre-session trading around $261.00 before retreating to retest support levels. Holding above $256.20 suggests a potential retest of the $261.50-$262 range.

A break above this level would target $266, which represents a significant resistance level. Conversely, a drop below $256.30 would threaten the continuation of the short-term uptrend. Price Action Summary

Apple stock experienced a sharp decline during the first quarter (Q1) of 2025, dropping from $248 to $168.60. Following this, the stock entered a consolidation phase within a sideways range that lasted from April to August.

Later on, the stock rallied, supported by a series of higher highs and higher lows. This recent rally took the stock to an all-time high near $288.60 before a sharp correction, reflecting normal profit-taking after a strong upward surge, without breaking the main trend.

This represents an increase and growth exceeding 70% compared to its level at the beginning of 2025.

Disclaimer:

This analysis is based on technical analysis tools and reflects a comprehensive analytical view that may vary depending on interpretation methods.

It does not constitute a direct recommendation to buy or sell, nor an invitation to make investment decisions. This is intended solely for monitoring and study purposes. Investment decisions are the sole responsibility of the investor, based on their financial situation and investment goals.